Gary Chown ACIB MCIBS Chartered Banker

Director, Commercial Banking, NatWest Bank

E-mail: gary.chown@natwest.com

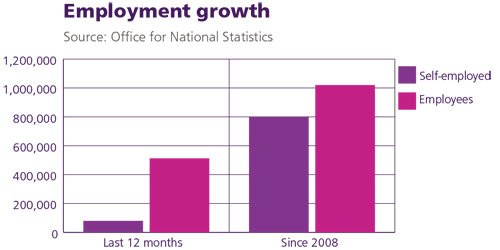

Think about job growth and most people picture big employers hoovering up extra workers, but it’s the plucky start-ups that are the heroes of the UK’s jobs recovery. The number of people working for themselves has grown by over 20% since 2008, far outpacing the 4% rise in employee jobs.

Their contribution to falling unemployment has been massive and the rising phenomenon of people starting out on their own has been overlooked for too long.

Self-employment played a critical role early on in the teeth of the crisis. Firms shed over half a million jobs between 2008 and 2010 as the recession hit. Yet self-employment expanded by 150,000 as people took their future into their own hands. That counter-cyclical role is part of the reason unemployment rose less than had been feared.

But its impact didn’t end there.

As growth returned and firms started hiring again you might have expected self-employment to fall away. Instead we’ve seen continued increases, even as the unemployment rate falls to pre-recession levels. So who are these new wave of entrepreneurs and why are they shunning the traditional ways of working?

Self-employment amongst women has grown three times as fast as men since 2008, rising by over 40%. Today, 1 in 10 working women are self employed, closing the gap to men who historically have been much more likely to work for themselves. Flexibility over working arrangements is likely to be playing a role in this trend as the self-employed can gain greater control over when and where they work.

Flexibility is an increasingly important theme in the labour market and lies at the heart of much of the increase in male self-employment too. Here, particularly strong growth amongst men over the age of 65 shows how many people are using self-employment to smooth the transition to retirement. That can be a very positive thing, exploiting the skills and networks that a lifetime of employment has built up. But it can also be a sign of supplementing disappointing retirement income. With annuity rates at record lows that effect will increasingly be felt.

London is the centre of the UK’s self-employment boom, seeing a staggering 40% increase since 2008. This performance has helped mean 1 in 3 of the net new jobs created since 2008 has been in the capital. Sussex leads the way in the self-employment revolution. In the index of UK major towns and cities, Sussex has an incredible six entries in the top ten, with Eastbourne leading the way with 21.5 % classified as being self-employed. This is also a genuinely national phenomenon.

Self-employment growth has outstripped employee job growth in every region across the UK since 2008. It is a response to economic conditions and to changing demands from workers. Without it, the UK’s record-breaking job recovery would have been a lot weaker.