When I decided to write for the premiere issue of Dynamic, I wasn’t sure about how or what I was going to write. I thought about addressing the problem of increasing the numbers of women in STEM, but it seemed to me to be a fairly well trodden path and with WISE (Women in Science and Engineering) leading the charge, probably one to avoid.

We specialise in working with SMEs with a turnover of up to £50m to claim the government’s Research and Development Tax Relief (R&D Tax Credits as they are more widely known), Video Games Tax Relief and Patent Box. The principle of R&D Tax Credits is that the company making the claim has to be advancing global Science or Technology through the resolution of scientific or technological uncertainty. In essence STEM is at the heart of every claim.

Initially in my research for the article I started to review the number of women-led businesses that we work with and found that of the 120 clients on our CRM, only eight were owned/led by women, that’s 6.6667%. Looking at WISE’s statistics that’s equivalent to the percentage of women in executive positions on the boards of FTSE 100 companies in 2017!

(www.wisecampaign.org.uk/statistics/boardroom-stats-2018/)

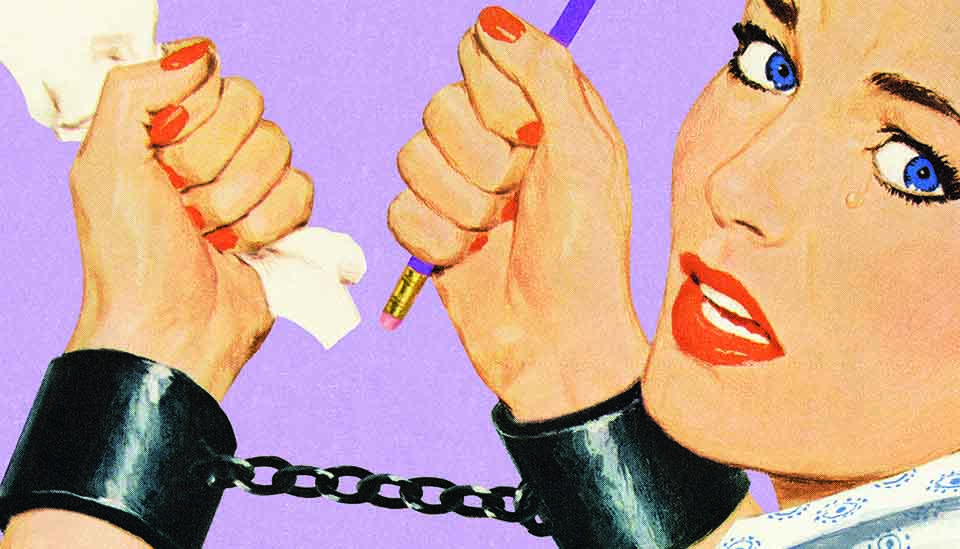

I decided on the above heading, when I found out that I was guilty of bias, though I hope it was unconscious. I had been in communication with Steve Elford and Milly Stone from Whitespace Creative Studios in Brighton about looking at a R&D Tax Credits claim for their business. It wasn’t until I got an email from Milly on the eve of our meeting that I noticed that she was the Managing Director of the business. At the end of our meeting I apologised to her, and mentioned that I’d try and make it up! (She said she’d be happy with a bit of free publicity!)

So, if I am unconsciously biased, has it actually had an effect on the companies that I am attracting as clients? Will it have a negative impact on my business? Are there things that I can put in place now to change that?

The simple answer to the first of these is “I don’t know”. I don’t go out of my way to deter female-led businesses, but I am sure if I don’t attract them it will have a negative effect on my business. It is important to act.

I have booked a stand and speaking slot at Women in Business Exhibition in Farnborough on 16th-17th October (where Dynamic will be launched). I’ll even have a special offer for women-led businesses who want to claim R&D Tax Credits.

I am also looking to grow the business so if you have experience in STEM and fancy a slight change in your career please get in touch. We are looking for someone who wants to help businesses grow and who might be able to write technical reports to support the tax claims. We are also looking to set up a grant writing team to help our clients to bid for R&D grants. Don’t worry about having to be in Sussex, you don’t, we’re flexible!

• If you’re interested in finding out more about R&D Tax Credits, you’d like to make a claim, or you might be interested in joining the team, why not contact us through www.coodentaxconsulting.co.uk or phone 01424 225345 and ask to speak to Simon.