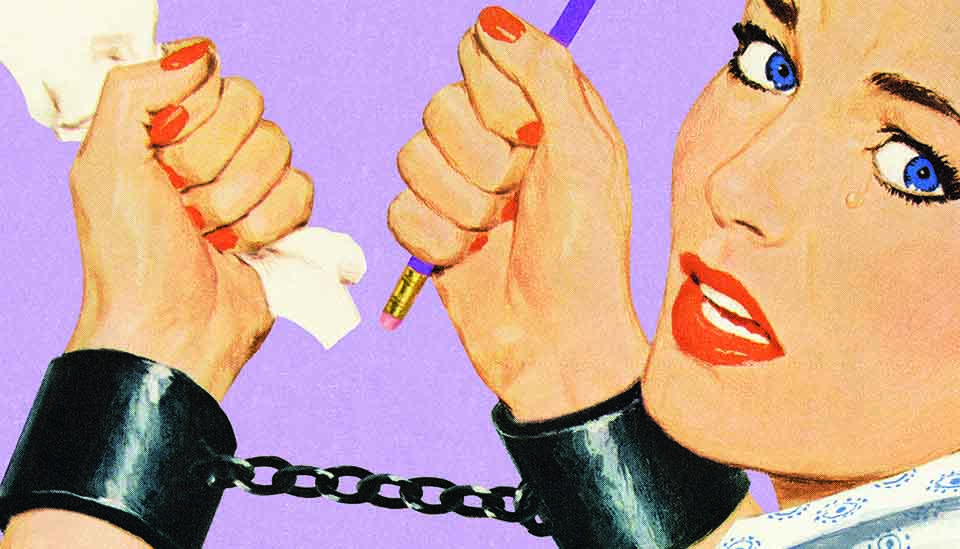

Women are, of course, just as interested as men when it comes to understanding and making the most of their financial affairs. However, despite our educational and career advancement, women are still largely overlooked by the financial industry and the image many women have of financial advisers steers them away from seeking advice.

Whether you are at the start of your career or want to make the most of the assets you have worked hard to build up, it’s important to have a plan in place that will provide you with financial security. Employing a professional adviser can save you money, time and a lot of worry. They can help you to define your financial goals, sort out the tedious paperwork, and better manage your savings and investments.

The key to finding the right financial adviser is working out what type of advice you need and finding a qualified professional who makes you feel confident about your decisions.

What are the differences between advisers and planners?

Financial advice comes in many different guises. There are several professional titles that are often used interchangeably, but actually refer to different capabilities and offerings. When looking for general financial advice, the most common titles you will come across are Independent Financial Advisers (IFAs) and Restricted Advisers. Both are qualified and regulated in the UK by the Financial Conduct Authority (FCA). This means that there are rules they must follow when dealing with you.

What is an Independent Financial Adviser?

Many people start by seeking answers to specific questions. How can I be more tax-efficient with my savings? Which pension should I choose? Can I get a cheaper mortgage? Do I have the right insurance?

Restricted financial advisers often work directly for banks or large networks and are restricted in the type of products they can choose from or the number of providers they can offer. For example, an adviser at your bank may only be able to offer you their insurance solutions.

An Independent Financial Adviser (IFA), on the other hand, is most importantly, independent. They are not restricted in the type of advice they can give, either in relation to specific products or the providers they can recommend. You therefore know that you will be getting the widest choice of solutions available. It’s important to ask if they are independent or restricted.

What is a Chartered Financial Planner?

Some professionals may have more than one type of accreditation, and the lines blur a little between advisers and planners, with some professionals offering both services. The main difference is in what you hope to achieve. A financial planner will help you to define your financial goals and show you the best ways to achieve them, bringing together your spending habits, insurance and taxes, savings and investments, pensions and properties.

For women, the lifestyle planning process tends to be very important. A financial planner can carry out cashflow modelling to visually demonstrate your entire financial life, analysing your present circumstances and projecting your future with a comprehensive long-term plan. I’ve known high earners that feel depleted every month, wondering where it all goes. Working with a financial planner can be life-changing.

Building a good relationship may take time. You should feel that your financial adviser has listened to your needs and fully understood your goals. Whatever is right for you, what’s important is to overcome any financial barriers to success.

Tracey Evans is an Associate Director at Progeny Wealth. She is one of the most qualified individuals in the financial planning profession, as a Chartered Financial Planner, Certified Financial Planner™, Registered Life Planner®, Chartered MCSI and Chartered Wealth Manager.

Connect with Tracey on LinkedIn, call +44 7825 070 660

or email tracey.evans@theprogenygroup.com

Progeny Wealth is authorised and regulated by the Financial Conduct Authority.