Since COVID-19 hit our shores many UK businesses have had their benefits strategies tested, with HR leaders now starting to reflect upon how well they fared when their employees needed more support than ever before. Nobody could have predicted what we have all experienced, however some businesses, by virtue of investing in their people over the years, have been on the front foot and performed particularly well during these tough circumstances.

In the past, employers have been sold various Employee Benefits with the narrative solely focused around protection, highlighting scary tales of what it could mean if the worst happened.

It’s a shame really, and a huge opportunity missed that those advising businesses have not instead, adapted their patter to promote wellbeing and focus on areas where employees can extract regular and meaningful value.

Of course, the protection element shouldn’t be discounted, but in a world where Employee Benefits and their incumbent tertiary services are developing at rapid pace, a more holistic approach to benefits consultancy should be sought.

Let’s start firstly by considering how various Employee Benefits were ranked by Employer and Employee alike, pre-COVID-19 (see bottom of page).

Some of the most highly rated benefits from this research, such as Private Medical Insurance, have been rendered almost inaccessible over the last few months as the NHS, rightly, commandeered private settings in preparation for a potential rise in the COVID-19 infection rate. Thankfully, the swathe of patients needing hospitalisation didn’t materialise and our NHS coped fantastically well within their own capacity. It is now reported that NHS waiting lists could reach 10 million for non-urgent procedures, so whilst private treatment hasn’t been available of late, it’s a market that is expected to grow dramatically.

Health Cash Plans were also largely under-utilised as appointments for dental, optical and physiotherapy (which make up the lion’s share of claims) couldn’t take place. In terms of employee popularity, Cash Plans have overtaken traditional medical insurance because cover for everyday healthcare costs inspires a higher perceived value. It is believed that these claims will now catch up as employees are able to access treatment.

The real “stars of the show” have come from the in the form of Wellbeing Services, which historically rank low in employer/employee perception, but deliver brilliantly.

Ironically, these are often the most inexpensive benefits to provide and frequently come free as part of existing products, but are unknown to the employers or poorly communicated.

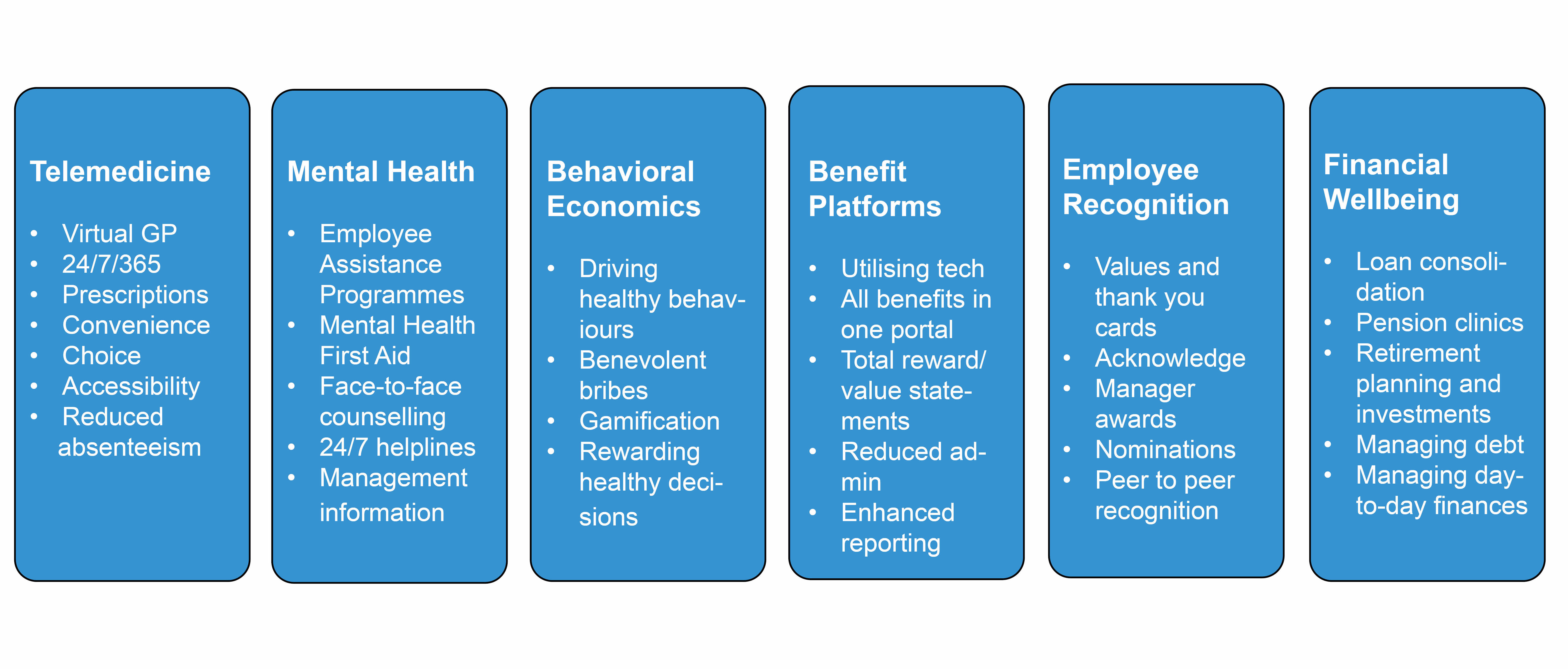

Emerging Employee Benefits

Telemedicine/Virtual GP

A few years ago, there was a suggestion that GPs could work six days a week in order to better serve patients and reduce waiting times. In truth, up to 70% of GP consultations do not require any physical examination, and therefore the rise of Telemedicine (via smart devices/apps) is a great initiative. If the 70% were all to access remote services instead, it would generate significant capacity for the remaining 30% who required more face-to-face time.

What’s more, there is huge benefit to employee and employer alike when this is offered through work:

• Employees can choose a time which suits them to speak with a GP, meaning less down-time and faster triage/diagnosis.

• Employees can select a GP based on specialism and gender, with photos of ailments able to be taken and uploaded in advance of the call.

• Prescriptions can be approved on the call and delivered directly to home addresses.

• Technology is evolving to incorporate new initiatives, such skin cancer detection as part of the app/phone camera.

Employee Assistance Programmes

Shortened to EAP, the aim of an Employee Assistance Programme is to provide confidential, independent, impartial and unbiased guidance to employees who could be suffer- ing in a range of lifestyle areas.

With a 24/7 helpline and counselling sessions included, employers can feel assured that they are not only satisfying their Health & Safely obligations, but also supporting employees who might otherwise not have a sounding board or advice outlet available to them.

Some of the key areas that employees utilise an EAP are as follows:

• Mental Health

• Eldercare

• Addiction

• Terminal illness

• Debt and financial problems

• Bullying and harassment

• Stress

• Identity & LGBTQ

• Domestic abuse

• Bereavement

Behavioural Economics/Gamification

More and more benefit providers/insurers are adopting behavioural economics into their products. This acknowledgement that traditional insurance products only deliver value when the worst happens and don’t engage the workforce, has encouraged new entrants who want to interact with employees throughout the policy year.

One example is Yulife, a provider that offers Group Life, Income Protection and Critical Illness plans, but with significant focus on rewarding healthy behaviour. Employees who have access to products like this have continued to engage with them during lockdown, and have remain connected with their employee benefits even if furloughed.

There is no one-size-fits-all when developing a company employee benefit strategy, but whatever is decided upon, communication is absolutely paramount. The benefits that have been most heavily utilised during the last three months are actually the benefits which are deemed as secondary considerations at point of sale/implementation.

Engage Health Group is an independent, whole of market Employee Benefits Consultancy offering design, broking, implementation and management services, completely free of charge to businesses

with between 3 – 3000 employees, worldwide. Visit us at engagehealthgroup.co.uk

Tel: 01273 974419

Mob: 07834 952516

Skype: Engage Health Group nick.hale@engagehealthgroup.co.uk

www.engagehealthgroup.co.uk