Is your business ready for 1/1/21 and the end of the transition period?

Are you a customs agent?

Or does your company use customs agents and intermediaries to help you trade with the EU?

If so, you need to know how to meet customs requirements fast and efficiently. The United Kingdom has already left the European Union but remains in the customs union during this transition period which ends on 31st December 2020. There will be new processes to follow and new forms to complete.

We can help.

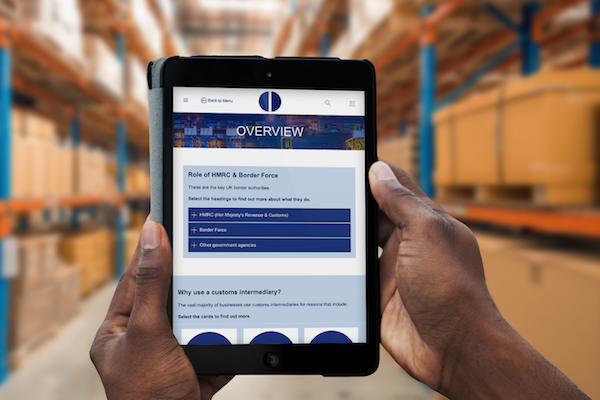

Surrey Chambers of Commerce has partnered with some of the leading industry experts to launch brand new Online e-learning Customs Declarations Training designed to prepare business- es and trade professionals for the future of trade.

The way we trade with the EU is about to change, introducing the need for forms and processes not previously required. Up-skilled people will be the key to continued success once the UK leaves the EU.

The Customs Declarations Training programme delivers flexible, bite-sized e-learning modules wherever you are. Who is it for? Anyone who needs an understanding of Customs regimes and how to complete a Customs declaration form – Shipping, exporting staff, importing staff, management at all levels, logistics, freight forwarders.

Grant funding: Applications for HMRC training funding is still available at https://www.customsintermediarygrant.co.uk/

Course content is based on the following topics:

• Introduction to Trade

• Business Responsibilities

• Export process

• Import process

• Valuation – explanation of the main methods and their application

• Classification – determining the use of commodity codes

• Using Customs Procedure Codes – use of appropriate CPCs

• Export and import controls

• Reliefs

• Preferences

• Customs simplified procedures

• Explanation of procedures and benefits

Assessment: Once the module has been completed, delegates will get to complete a short assessment of learning after each module and will receive a certificate.

Price: Chamber members £190 + VAT

Non-members £230 + VAT

Registering interest: To register interest or for more information, please email Gary Hayes (gary.hayes@surrey-chambers.co.uk)

INTRODUCING CHAMBERCUSTOMS

With the unprecedented times that businesses across Surrey are living; dealing with the COVID-19 outbreak and subsequence lockdown and restrictions, its very easy to forget that the UK is still marching towards leaving the EU on 31st December 2020, the last day of the transition period aimed at providing adequate time for business- es to make the necessary changes to how they trade with the EU.

One of the biggest worries for businesses is being prepared for the new trading and customs regulations that will come into effect at the end of the transition period. The biggest challenge is being prepared to make customs declarations for the importation and exportation of goods between the UK and EU.

The UK government estimates that the level of customs declarations will increase to 250 million customs declarations and have stated that there will be the need for 50,000 new customs agents to meet this increase in demand. It remains to be seen if the UK government will manage to meet this target with the months that are remain- ing, and even more so, with the additional challenges that COVID-19 brings.

There are quick wins that a business can do to be prepared for December 31st. Check that you have your EORI number. If you have not got an EORI number and you trade with the EU, you need to obtain this from HMRC. How much trade do you do with the EU compared to the rest of the world and estimate how many more customs declaration you may need to make?

But just as importantly, what assurance and compliance plans have you got in place with your customs broker? Remember, you may incur penalties from HMRC if you make errors.

Help is at hand though –our brokerage service, ChamberCustoms, is unique because it harnesses the reach, expertise, and knowledge of our 53-strong Chambers of Commerce network. With direct connections with every inventory port in the UK, we can assist in clearing goods for import and export.

We can access faster duty and VAT payments through our deferment account to make payments to HMRC on your behalf or help you through a flexible accounting system to pay HMRC directly. A potentially complicated process is made smooth, quick, and entirely transparent.

ChamberCustoms have stepped in to help build the much-needed capacity for traders to be able to get goods across the UK border. We have built software, trained over 130 people as Custom brokers across the UK and created the back-office systems, the policies, and the processes from the ground up. And that is just the beginning.

This service is available directly from Surrey Chambers of Commerce, one of 30 locations ChamberCustoms will be operating from in the UK. Chamber- Customs offers an HMRC compliant service that you can trust.

For more information and to register your interest in using this service, please visit www.chambercustoms.co.uk or contact Gary Hayes on 01483 735540 or email gary.hayes@surreychambers.co.uk